About 70% of Americans over the age of 65 will need LTC services during their lifetime. This year, that number is expected to exceed 12 million people.

Developing a chronic illness can take a physical, emotional, and financial toll on you and your loved ones. Let’s give you the peace of mind that when you need the care, it will be available.

Indemnity-based

Get the care YOU want! (In-home, supervised, nursing facility, etc.)

Return of Premium

If you never need it, all of the premiums will be returned.

Waiver of Premium

Once on the claim, no further premium is due.

Indemnity-based

Get the care YOU want! (In-home, supervised, nursing facility, etc.)

Return of Premium

If you never need it, all of the premiums will be returned.

Waiver of Premium

Once on the claim, no further premium is due.

Average costs of Annual Care

92,376

45,536

62,365

Optimize retirement with a game changing strategy.

A generation ago, many people retired on the lifetime income from company pensions. But today, over 85% of retirement assets are in defined contribution plans and IRAs.* More than half of working-age Americans are concerned they won't have a financially secure retirement.* And designing effective strategies to replace the guaranteed income from defined benefit plans has become a core challenge of modern retirement planning.

*IRI Retirement Fact Book, 2020, page 10.@2020 Insured Retirement Institute. **Retirement Insecurity 2021, page 11. National Institute on Retirement Security. February 2021.

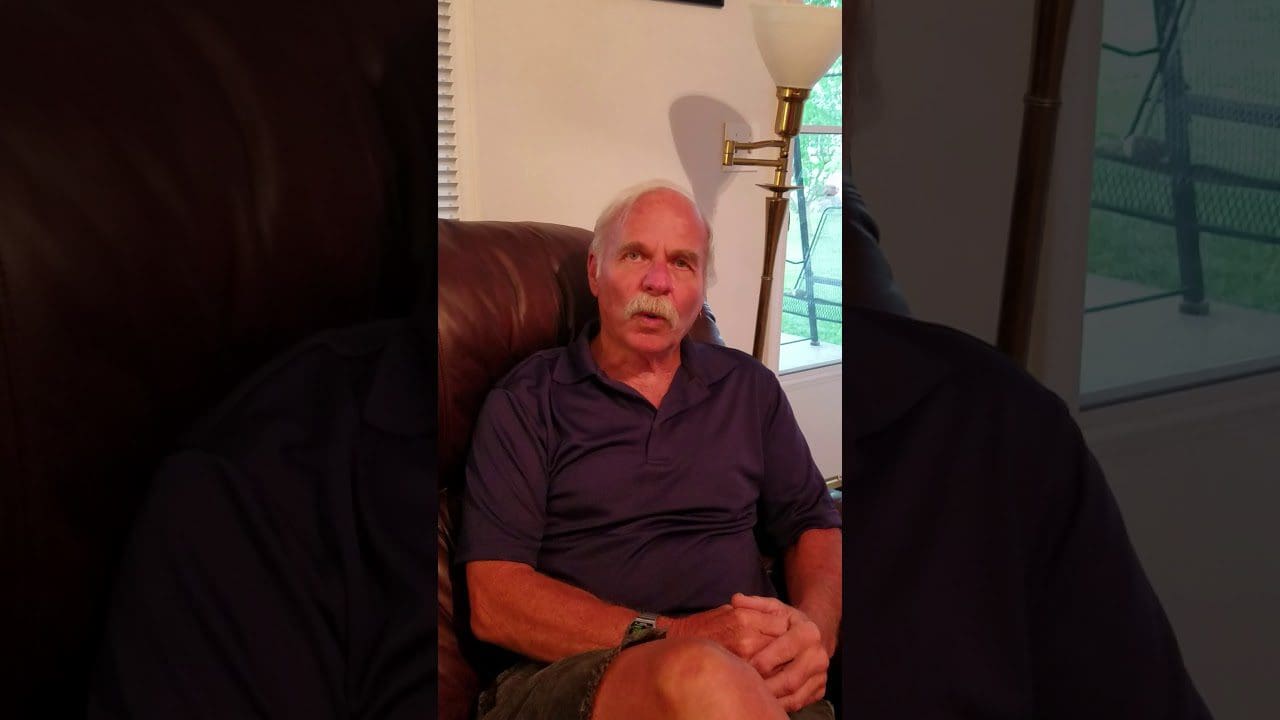

39 Years of Experience

To us, You are Family

Keibler & Associates has been helping people with financial planning for 39 years. We know how hard it is to understand all the financial issues involved with caring for your loved ones in nursing homes or assisted living. You can trust us to guide you through the financial aspects of it. Keibler & Associates offers free consultations to evaluate your situation and present a proposal at no charge to your family.

Preserving Your Family’s Assets

How Can Keibler & Associates Services Help?

Keibler and Associates help individuals who are no longer able to care for themselves. These individuals may need or are already receiving, assisted living, additional in-home care, or nursing home care. We help these individuals qualify for financial assistance through Medicaid or VA Pensions.

This is done without the individual having to lose all their assets to the nursing home or the state. Keibler & Associates will be able to sit down with you and determine whether you may benefit from these programs and be able to preserve your family’s assets. Keibler and Associates can also help non-spouse family members receive compensation for the care they provide in assisting at home.

What’s Involved in The Process?

1

Contact Keibler & Associates and schedule a consultation. Keibler & Associates offers free consultations to evaluate your situation. Every family situation is different, so it takes an experienced adviser to access the situation and take necessary steps in preserving your assets.

2

We then review the information and determine what level of care the family may qualify for at this time. Then, we present a proposal at no charge to your family that will give a good summary of what assets could be saved and how we will do it. Generally, with a husband and wife situation, we can save basically all of their assets.

3

Your family decides if they’d like to move forward with services. Keibler & Associates assists along the way with acquiring necessary financial documents and filing appropriately to get approval for Medicaid or VA Pensions.

Consulting

We are passionate to help families get the care giver services they need without draining the family of all their assets. We do make house calls and nursing home visits to meet with families as needed. We can also help assist in finding the appropriate care facility for your loved one.

Free Consultation

Frequently Asked Questions

What is Veterans Aid and Attendance?

A monthly tax-free income benefit that is payable to veterans for the spouse of deceased veterans who served during a war period. They do not need to have been in combat nor is the country of war. The individual also will need to quality medically as needing ongoing assistants of another person “excluding the spouse” and performing two or more of the activities of daily living “adls”.

How can I get help paying Nursing Home Expenses?

Most people who enter nursing homes do not qualify for Medicaid at first but pay for the very high costs of this care through long-term care insurance or out of pocket until the insurance runs out and/or they have spent down their savings and are then eligible for Medicaid. Eligibility depends upon how much an individual has in assets.

How do I qualify for Medicaid to help with Nursing Home Expenses?

The rules vary from state to state but normally an individual can have 2K or less in their name. A couple with one in a nursing home may find more favorable rules with their assets. Can I keep my home if my spouse goes in to the Nursing Home? If Medicaid pays for your husband’s care in the nursing home, you will not have to contribute anything from your income towards his cost of care. Generally you can keep the home as the community spouse.

Can we get Nursing Home Financial assistance even if we have assets?

Yes! Medical Assistance coverage for nursing home care has both financial and medical eligibility rules. The financial eligibility rules are discussed in the questions below. This leaflet does not answer all the possible questions about Medical Assistance for nursing home care. Each person’s situation is different, and the result depends on the exact facts. There are proven financial strategies that can be used to help families save assets and still qualify for financial assistance.

What’s the average cost of a Nursing Home per month?

National average costs for long-term care in the United States (in 2016) averages $225 a day! Does Medicare pay for Nursing Home care? If you qualify, then Original Medicare may cover expenses related to your nursing home care in a skilled nursing facility for the first 100 days as follows: For days 1 to 20 of your stay during the benefit period, you pay $0. For days 21 to 100 of your stay, you pay $167.50 per day in 2018 as coinsurance. Is there a way to protect my assets so the Nursing Home doesn’t take them? Long term care insurance is an option. You should discuss your situation with an experienced nursing home consultant.

I can’t afford Nursing Home care for my loved one and I can no longer care for them. What can I do?

This individual may qualify for Medicaid. They may still have assets that would normally disqualify them but there are ways to save those assets. Consult with an experienced nursing home planner and find out your options during a FREE consultation.

If my spouse goes to the Nursing Home, the Nursing Home will take their income. How will I survive?

You can keep your income. Medicaid calculates what you need as monthly income based on a fixed formula (not necessarily what you really need). To the extent your own income is less than the amount they determine, you may keep part of your spouse’s income to make up the difference. This is done on a case-by-case basis.